The goalposts for investing in early-stage companies seem to have shifted recently. I’ve heard a lot about product-market fit and that investors are asking for more proof of traction (or recurring revenue) before making early-stage investments.

Here’s what I’m hearing from founders:

- We’re super early, so we don’t have traction to show yet. What should we tell investors?

- How can we prove we have product-market fit?

- Every investor I talk to wants me to show proof of revenue, but we’re not there yet.

Here’s what I’m hearing from investors:

- How many users do they have?

- What’s their ARR?

- Who on their founding team comes from the industry in which they’re trying to solve a problem? Has anyone been up close with this problem?

Once upon a time, product-market fit meant finding a “good market with a product capable of satisfying that market.” This definition leaves the door open for early-stage, pre-revenue companies to still have found PMF if they have identified a real problem in a “good” (by VC standards: big enough) market. Ideally, startups would also have the right founding team to bring the solution to market—people who have experience with the problem themselves and know how to build a company to solve it.

But lately, I’m hearing more early-stage investors raise the bar by equating product-market fit with traction or revenue. This incorrectly eliminates some promising pre-seed and seed companies from the conversation. It is possible to achieve product-market fit pre-revenue by building the right thing for a specific audience who has indicated interest before you start making money

Hot take: If you require proof of traction to determine PMF, stop calling yourself an early-stage investor. Early-stage companies don’t need to have traction to achieve product-market fit.

The market is correcting itself, and we have higher standards for writing checks these days, but that doesn’t mean we should stop investing in true early-stage companies altogether.

It’s still possible to invest wisely pre-revenue or pre-traction.

If investing is a gamble, then investing in the pre-seed and seed stage companies can sometimes feel like flipping a weighted coin (the unfavorable way). Here are some thoughts and frameworks I use to help judge whether an early-stage company:

- Has found PMF pre-traction.

- Is on the brink of finding PMF.

- Is a good/bad investment.

Let’s flip the weighted coin in our favor.

1. Current revenue won’t make up for lack of vision .

If you require proof of revenue today because you feel like the founder’s vision is too small, pass on the idea and tell the founder the truth. Just because an idea generates revenue in the early stages doesn’t guarantee it will be a unicorn. And just because a founder can’t show you revenue in the early stages doesn’t mean they don’t see a clear path to $1B TAM

2. Find proof without traction .

Look for ways early-stage companies are proving PMF without traction like:

- A founding team with first-hand knowledge of the industry they’re improving.

- Testimonials from interested & prospective buyers.

- Partnership conversations with impressive logos.

- Existing competitors, but none claiming market dominance

3. How the company originated says a lot about how it approaches the market

The product is more likely to fit a market if it started as problem-led because:

- The founders recognized a real problem and set out to solve it.

- They created a new technology in pursuit of solving a real problem.

They’re less likely to fit a market initially if:

- They just had an idea one day and weren’t sure what to do except start a company.

- They discovered a new technology but didn’t know immediately how to apply it to make a profit

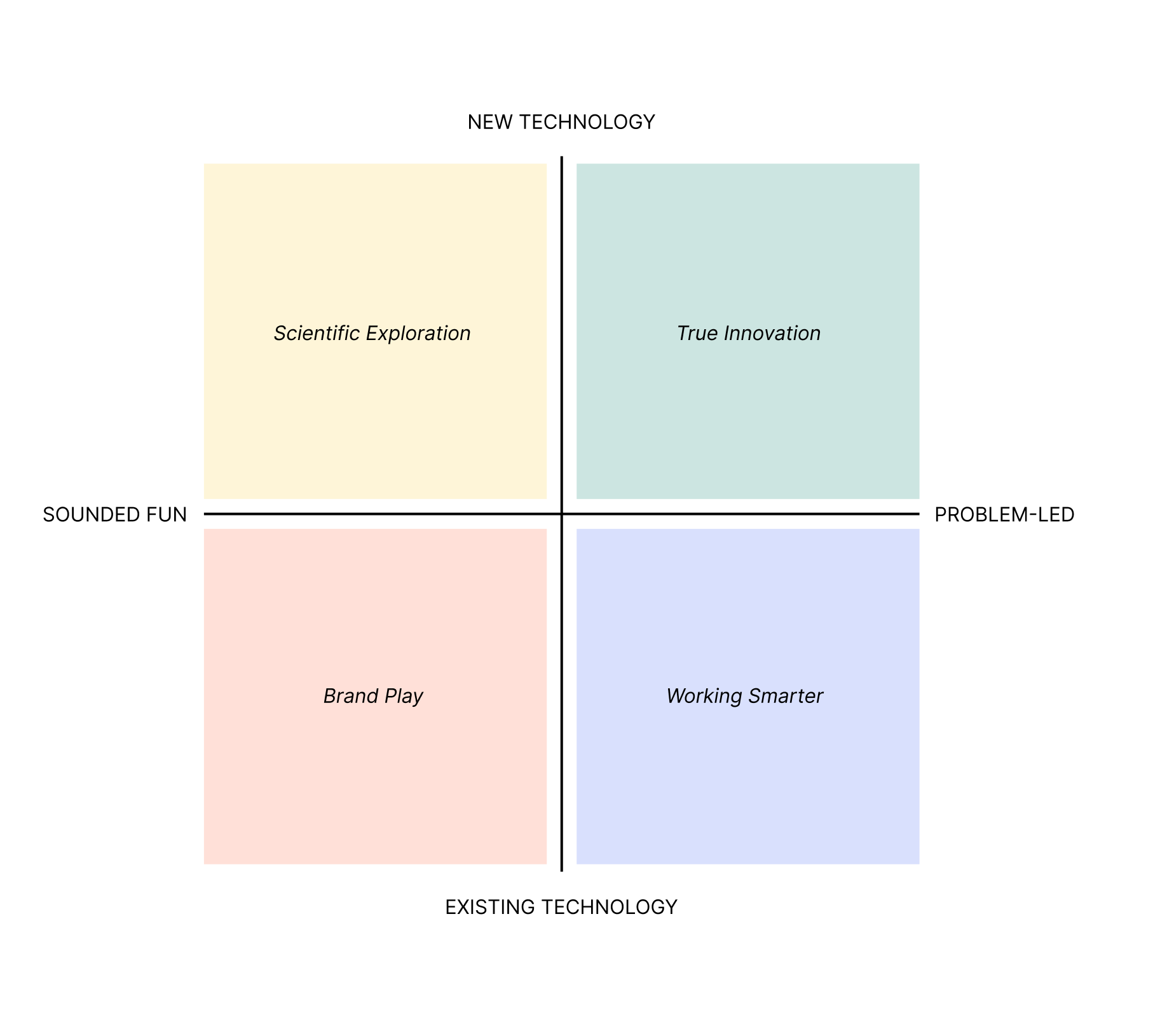

Consider the following matrix that shows the connection between problem-led innovation and product-market fit.

True Innovation and Working Smarter find product-market fit faster. Scientific Exploration and Brand Play take more time and effort. But in the end, Scientific Exploration and True Innovation are most likely to find success.

Let me elaborate.

True Innovation

Solving a real problem with new technology or a new approach will find product-market fit fastest and can lead markets.

Example: Salesforce pioneering the CRM.

These founders typically once belonged to the audience they are solving a problem for, or at least have first-hand knowledge of it.

Working Smarter

Solving a real problem with existing technology will attract buyers and users while launching you to the middle of the adoption curve. However, you’re going to deal with a more saturated competitive landscape, and need to prove that you’re creating a moat in some other way.

Example: Typeform didn’t reinvent the online survey, they just made it more user-friendly and delightful.

Typically companies who start “working smarter” have significant innovation planned on their roadmap, or plan to differentiate with a brand play.

Scientific Exploration

Exploring and pushing the boundaries of what science and technology can do is (typically) good for the advancement of humanity as a species, but likely not going to achieve product-market fit until the problem to solve presents itself.

Example: Generative AI was developed with possibility in mind rather than any singular problem to solve.

A lot of university funds invest in faculty and student innovations that fall into this category. These ideas typically take longer to materialize in market

Brand Play

Starting a company or developing a product “for fun” (without solving a real problem) and using existing technology to do so will require massive brand equity to achieve product-market fit.

Example: Stanley Cups beating out Yeti for PMF with millennial and Gen X women.

To succeed, these ideas need an obsessive, sales and marketing-minded founder

If you’re an early-stage investor, it is possible, smart and some might even say a requirement of the job, to invest pre-traction or pre-revenue. But that doesn’t mean you need to throw money at ideas and cross your fingers. Product-market fit is achievable pre-traction. When early-stage companies can prove PMF, you can have more confidence investing in them. It’s time to get comfortable taking (calculated) risks again.

If you want to talk about ways in which product marketing and brand can help companies achieve traction and PMF faster, let’s connect. Your portcos may have built the right thing, they may just not know how to explain it—yet.